Allan Gray Money Market

The investment objectives of the Allan Gray Money Market Fund is to preserve capital maintain liquidity and generate a level of sound income. To protect against this risk the Allan Gray Money Market Fund invests in a range of instruments offered by different issuers so that it is not over-exposed to any single institution.

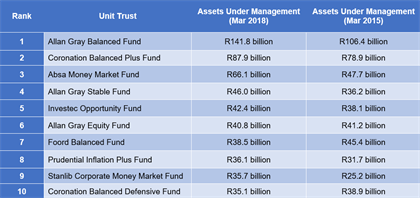

Ranked The 10 Biggest Unit Trusts In South Africa Right Now

Ranked The 10 Biggest Unit Trusts In South Africa Right Now

Contact Investonline today to find out more.

Allan gray money market. Allan Gray - Orbis Global Equity Feeder Fund This fund is currently available for basic unit trust investments. The majority of the. It invests in.

388 after all fees. Ad Search Faster Better Smarter Here. Allan Gray Money Market Fund is a unit trust incorporated in South Africa with over 26 Billion units as of 2020.

Ad Search Faster Better Smarter Here. The Allan Gray Money Market fund is a conservative fund that invests in local money market instruments. The total return an investor receives is made up of interest received and any gain or loss made on instruments held by the Fund.

The market is pricing in a 05 percentage point increase in December. Comprehensive Wealth is remunerated for its advisory and intermediary service by being paid commission from the product supplier and or by charging fees. Some funds such as the Allan Gray Money Market Fund try and buffer against this risk through diversification of issuers.

This fund strives to comply with retirement fund regulations. Interest rate movements were small in November with the exception of the three month rate which increased by 19 basis points. The fund aims to provide a constant level of growth by preserving capital.

The total return an investor receives is made up of interest received and any gain or loss made on instruments held by the unit trust. The money market rate as at 26 March 2021 is. Allan Gray is Africas largest privately owned investment management company focused on generating long-term wealth for investors.

If the issuer of the debt instrument goes bankrupt investors would likely bear a loss. Allan Gray Money Market Fund Price at 01 Apr 10000. The current benchmark is the Domestic Fixed Interest Money Market Unit Trust sector excluding the Allan Gray Money Market Fund.

While capital losses are unlikely they can occur if. The investment objective is to preserve capital maintain liquidity and generate a sound level of income. The Allan Gray Money Market Fund is not a bank deposit account The Fund aims to maintain a constant price of 100 cents per unit.

Allan Gray Money Market Fund is a unit trust incorporated in South Africa. The Allan Gray Money Market Fund is not a bank deposit account. The total return an investor receives is made up of interest received and any gain or loss made on instruments held by the Fund.

Allan Gray Money Market Fund 100 150 200 250 300 350 400 450 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Returns Fund Since Inception annualised 784 Latest 5 years annualised 736 Latest 3 years annualised 703 Latest 1 year 560 Performance History Period Ending Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec. Allan Gray Money Market Fund - 462 Invest Now Coronation Money Market Fund - 399 Invest Now All yields quoted above are 7-day rolling effective yields which are the applicable average NACM rates for the previous 7 days quoted on an effective NACA basis. The overnight repo rate of 35 is the lowest in South Africas history and offers only a marginal uplift relative to inflation of 31 year on year for August 2020.

For your savings we recommend investing into the Allan Gray Money Market fund. We recommend that investors make use of a Money Market fund for their short-term savings and goals. We have undoubtedly entered a difficult period for money market funds.

Current price 1 Apr. Money market funds invest in debt instruments. It has been good to be invested in money market funds over recent years.

The South African Reserve Bank SARB lowered short-term interest rates by 25 basis points in March. Month end 31 Mar. The Allan Gray Money Market Fund the Fund has returned 75 per annum over the last three years compared to 51 from the JSE All Share Index and 55 inflation.

In the unlikely event that an institution is unable to pay back the money some money may be recovered in the liquidation process. Allan Gray Money Market Fund is managed by Andrew Lapping and Gary Elston. During the preceding twelve-month period Comprehensive Wealth received more than 30 of its total remuneration including commission from Allan Gray Limited.

The unit trust aims to maintain a constant price of 100 cents per unit. If we reach our foreign investment limit. Allan Gray Money Market Fund commentary.

While capital losses are unlikely they. While capital losses are unlikely they can occur if for example one of. The Allan Gray Money Market Fund is not a bank deposit account The Fund aims to maintain a constant price of 100 cents per unit.

The second reason investors may not want to invest in a money market is credit risk.

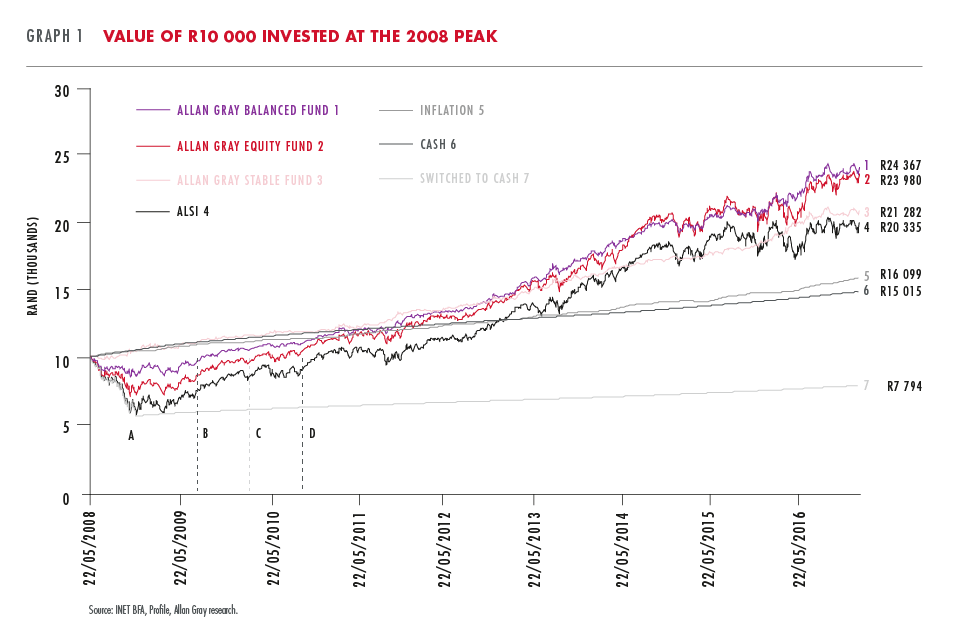

Allan Gray How To Be A Better Long Term Investor

Allan Gray How To Be A Better Long Term Investor

Allan Gray Australia Balanced Fund Allan Gray Australia

Allan Gray Australia Balanced Fund Allan Gray Australia

Allan Gray How Has Your Investment Been Impacted By The Fall In The Price Of Steinhoff

Allan Gray How Has Your Investment Been Impacted By The Fall In The Price Of Steinhoff

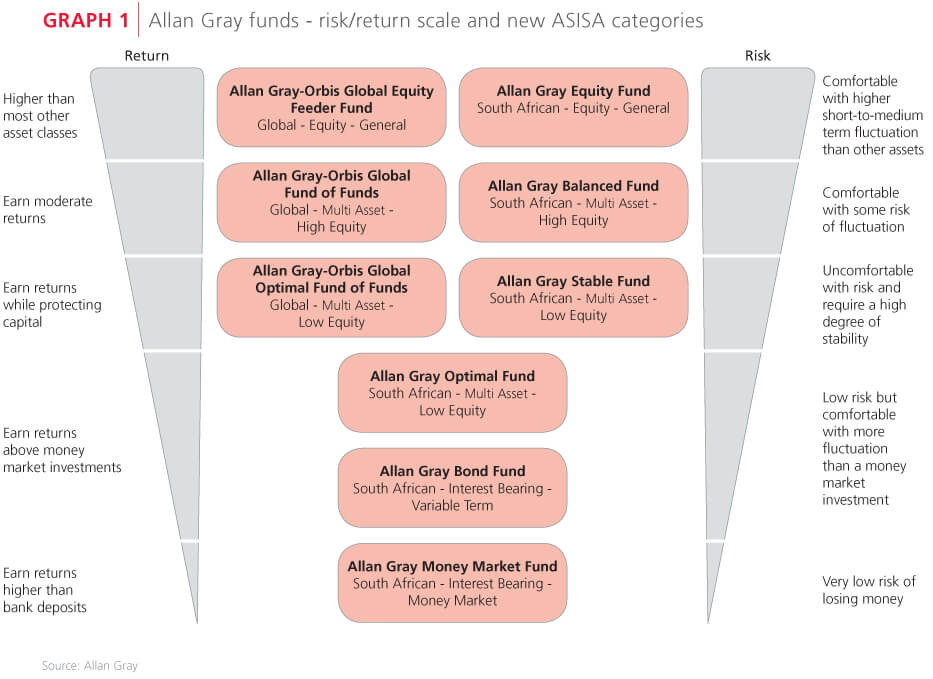

Allan Gray Making Sense Of Unit Trust Categories And Intentions

Allan Gray Making Sense Of Unit Trust Categories And Intentions

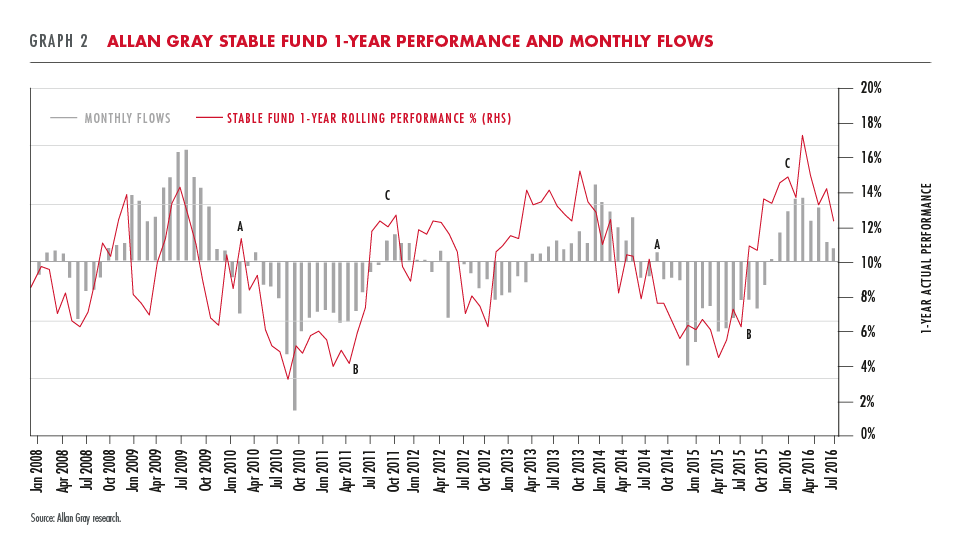

Allan Gray Money Market Fund Update Lower Yields Suggest Lower Future Money Market Returns

Allan Gray Money Market Fund Update Lower Yields Suggest Lower Future Money Market Returns

Post a Comment for "Allan Gray Money Market"