Cash Float Meaning

It is most obvious in the time delay between a cheque being written and the funds to cover that cheque being deducted from the payers account. This refers to the amount of cash placed in registers at the beginning of a shift or workday.

Petty Cash Float Bookkeeping Entries Explained.

Cash float meaning. Cash came into the business in the form of petty cash. Definition Float is money in the banking system that is counted twice for a brief time because of delays in processing checks or any transfer of cash as defined by the Federal Reserve Banks of United States. A cash float is a reserve of cash usually in a small amount.

In general a float represents a. Using a petty cash float top up When you operate a fixed float for petty cash called an imprest then the amount you top up is always equal to the amount that you spent. A cash manager among other tasks has to collect customers payments and concentrate them as well as managing the disbursements related to payments becoming due.

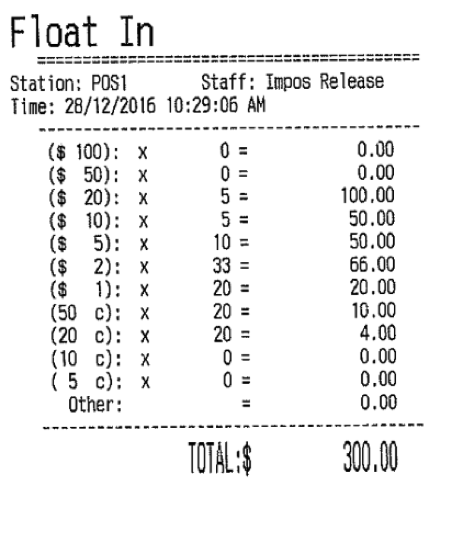

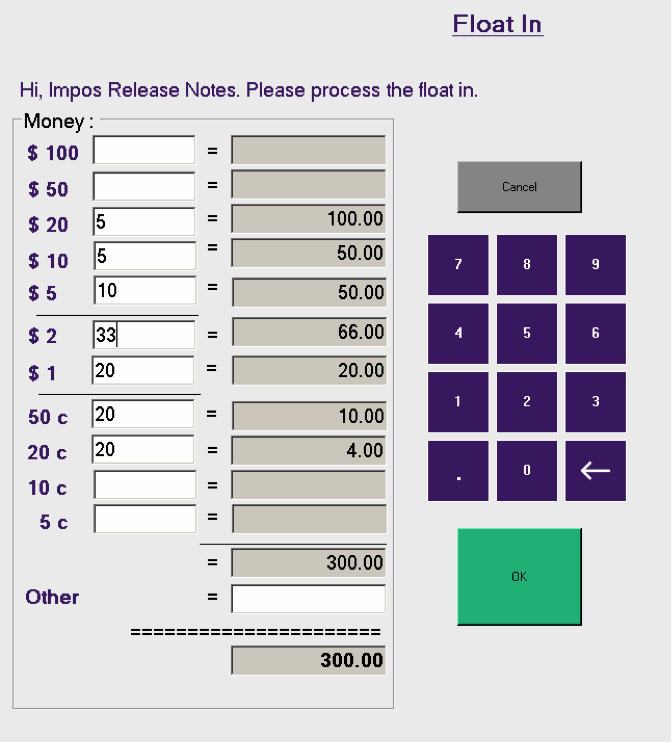

Cash Float Distributed Notes QTY Coins QTY 100 2 50 1 20 50 10 20 5 10 5 TOTAL. Cash float synonyms and antonyms in the English synonyms dictionary see also clashcrashcashiercase definition. The float is the period after payment is made with a check but before the funds actually move from the check writers account.

Because customers rarely provide the exact amount of money for the purchases the establishment of the cash float fund is to serve this demand. Understand cash float meaning and enrich your vocabulary. The efficiency of firms cash management can be enhanced by having knowledge and use of various procedures aiming at accelerating cash inflows and controlling cash outflows.

In the phrase cash down. Cash Floats can be collected from WORKSHOP on the day of use and must be returned 1 hour before closing business. 2 immediate payment in full or part for goods or services esp.

Float refers to the amount of money tied up between the time a payment is initiated and cleared funds become available in the companys bank account. Under this Imprest system the amount of money in the petty cash is kept at a fixed sum or float which can be 10000 depending on the size of the organization and its uses An initial float is given to the cashier or the custodian. For example if the float level is 100 and 80 has been spent the cash balance remaining is 20 and and further 80 is needed to take the float balance back to the level of 100.

In accounting and bookkeeping float is the time between the writing of a check and the time that the check clears the bank account on which it is drawn. You can also use this amount of money for specific expenses of the business. Debit What came into the business.

Cash float is the term for the total amount of checks in between the time when the check is written and taken off the books of the payer but not. Float is the amount of time it takes for money to move from one account to another. Traditionally the term comes from check writing.

There will generally need to be a cash in hand account which reflects monies drawn from the bank but not yet advanced to anyone this money should be in the company safe and when some of this money is advanced to a member of the production team entries need to be put through to the accounting records to reflect the transfer of money from the cash in hand to that individuals float account. Credit What went out of the business. Cash went out of the business checking account when it was withdrawn.

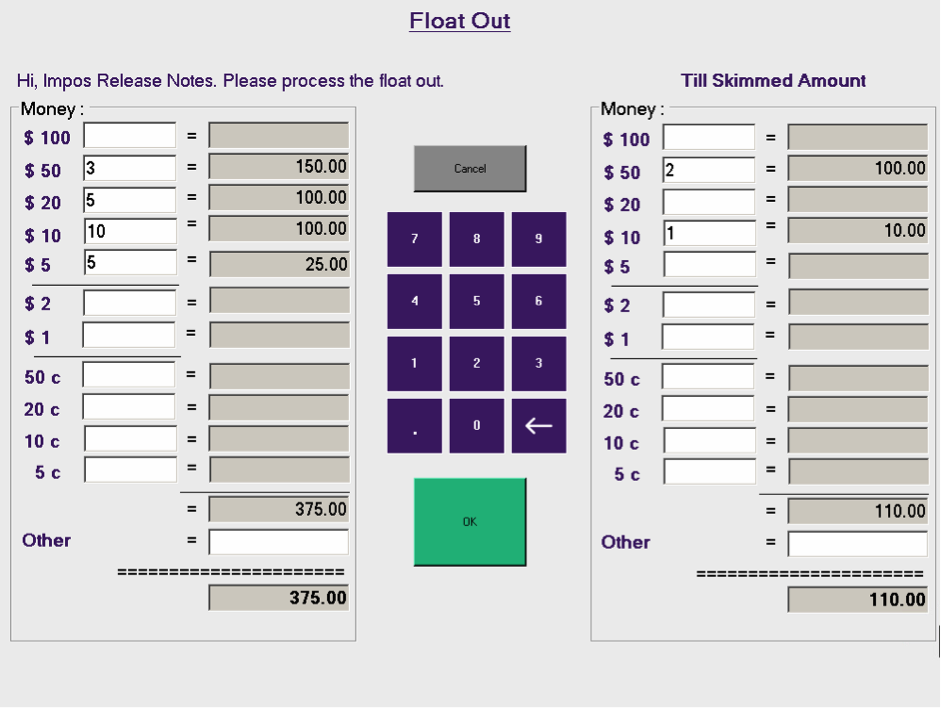

By signing this form you are responsible for the float and its return in full. Cash Float Returned Notes QTY. If you have too little float you may run out of certain denominations and end up with angry customers.

This figure is derived by taking a companys. However the check will not clear Payer Corporations checking account until Monday. The cash float typically consists of a nominal amount of money such as 50 broken up across several denominations and change.

Updated Jan 28 2021 The term float refers to the regular shares a company has issued to the public that are available for investors to trade. For example Payer Corporation writes a check for 5000 and mails it to a supplier on Wednesday. In other words he manages the time line of short term cash flows and there under also those related to receivablesConnected with these activities there are often delays.

Retail businesses including restaurants that frequently deal in cash often employ a cash float. Having a cash float which is the money you have in the register to give customers change when they pay in cash is an important business process. A bank account specifically set up by a business owner to float money through from Business A to enhance the perceived value of Business.

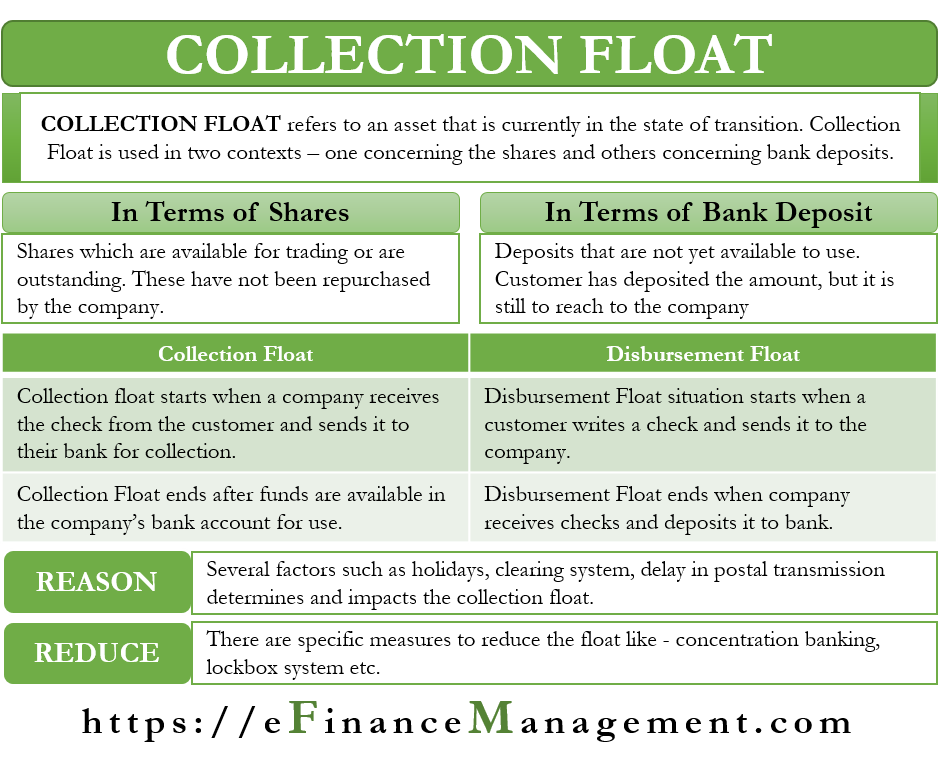

Collection Float Meaning Types And How To Reduce It

Collection Float Meaning Types And How To Reduce It

What Is Cash Float Definition Types Video Lesson Transcript Study Com

What Is Cash Float Definition Types Video Lesson Transcript Study Com

Set Up A Petty Cash Float Double Entry Bookkeeping

Set Up A Petty Cash Float Double Entry Bookkeeping

Slovnice Praznina Strmoglaviti Float Definition Veraciousmusing Com

Slovnice Praznina Strmoglaviti Float Definition Veraciousmusing Com

Post a Comment for "Cash Float Meaning"