Evaluate The Use Of Monetary Measures Applied To Ease The Burden On Consumers

Some Side Effects. A central bank such as the Federal Reserve in the US will use expansionary monetary to strengthen an economy.

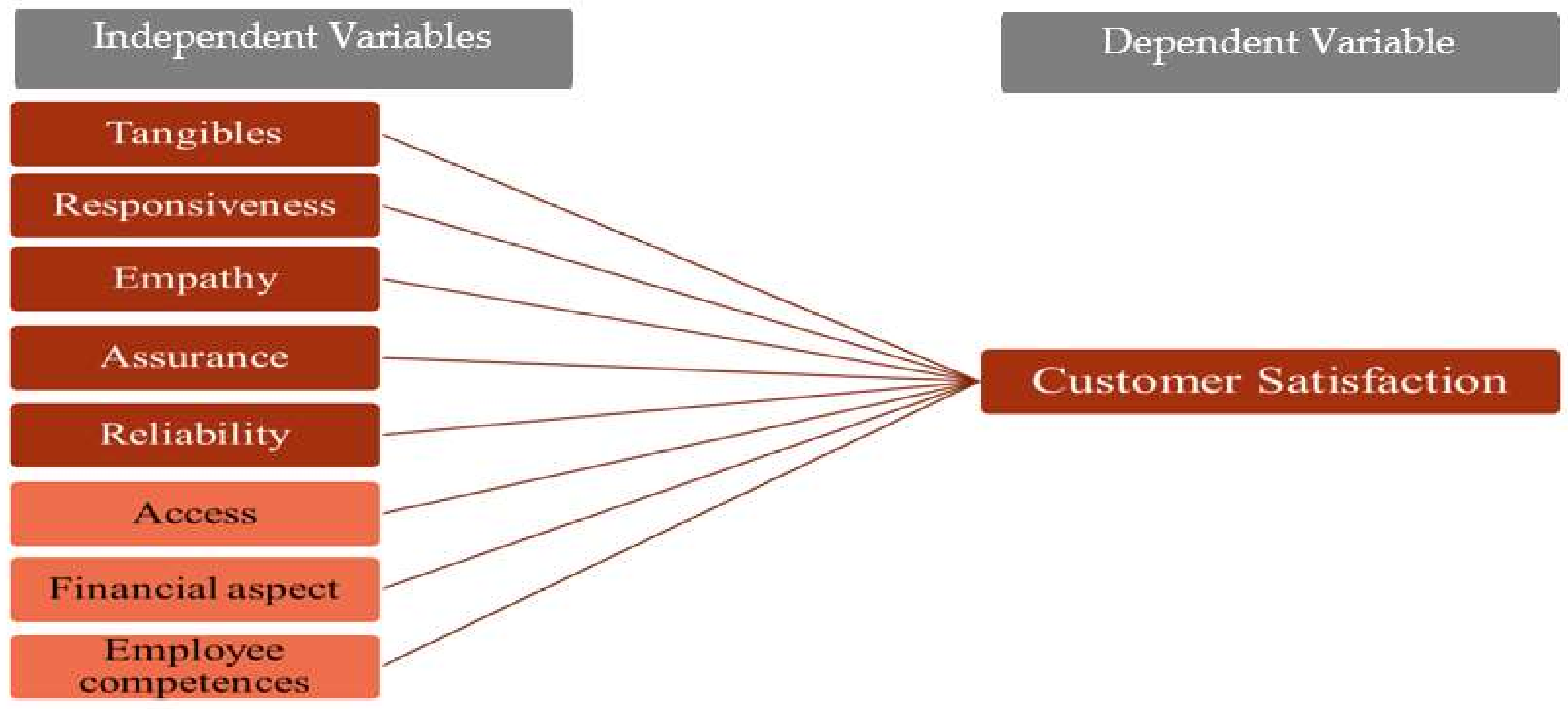

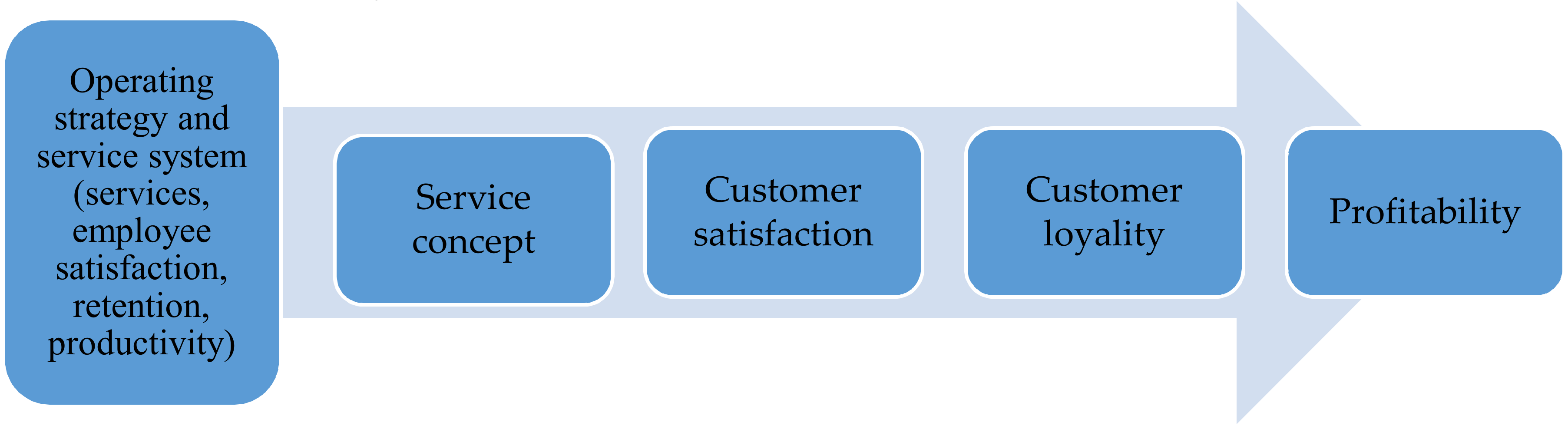

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

The updated study provides insights analysis estimations and forecast considering the COVID-19 impact on the marketFPNV Positioning MatrixThe FPNV Positioning Matrix evaluates and categorizes the vendors in the Aerial Work Platforms Market on the basis of Business Strategy Business Growth Industry Coverage Financial Viability and Channel Support and Product Satisfaction Value for Money Ease of Use.

Evaluate the use of monetary measures applied to ease the burden on consumers. As a result commercial banks increase their rate of interests on credit for the public. Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing borrowing by banks from each other to meet their short-term needs or the money supply often as an attempt to reduce inflation or the interest rate to ensure price stability and general trust of the value and stability of the nations currency. The Commonwealth Regulatory Burden Measure calculates the compliance costs of regulatory proposals on business individuals and community organisations using an activity-based costing methodology.

Just like monetary policy fiscal policy can be used to influence both expansion and contraction of GDP as a measure of economic growth. Since 2020 the Reserve Bank has put in place a comprehensive set of monetary policy measures to lower funding costs and support the supply of credit to the economy. Evaluate the use of monetary measures applied to ease the burden on consumers during the lockdown.

33 Evaluate the use of monetary measures applied to ease the burden on consumers during the lock down kuhlemgidi is waiting for your help. Countries use austerity measures to avoid a sovereign debt crisis. Monetary policy is one of the most commonly used measures taken by the government to control inflation.

Thats when creditors become concerned that the country will default on its debt. In monetary policy the central bank increases rate of interest on borrowings for commercial banks. It found that if the debt-to-GDP ratio exceeds 77 for.

Why Countries Agree to Austerity Measures. Thats the tipping point according to a study by the World Bank. We use these examples to illustrate the proliferation of metrics and to outline some of the problems regarding reliability validity and comparability that pervade existing codes8 We conclude with some practical suggestions that will help reduce the response burden on managers and yield more reliable valid and comparable metrics.

The purpose of this operation is to ease the availability of credit and to reduce interest rates which thereby encourages businesses to invest more and consumers to spend more. View IMG_20210406_130848jpg from ECON 1032L at Harvard University. Question Evaluate the use of monetary measures applied to ease the burden on consumers.

Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. Add your answer and earn points. Whatever the revenue-raising alternatives there are two other measures beyond lower multipliers and more frequent revaluations that could reduce the burden of business rates.

The tax burden measures the true economic weight of the tax measured by the difference between real incomes or utilities before and after imposing the tax taking into. It occurs when the debt-to-gross domestic product ratio is greater than 77. Solution for Evaluate the use of monetary measures applied to ease the burden on consumers during the lockdown.

We use cookies for a number of reasons. These measures affect the behaviour of borrowers and lenders economic activity and ultimately the rate of inflation. In economics tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare.

The selling of government securities by the Fed achieves the opposite effect of contracting the money supply and increasing interest rates. Path to net zero puts heavy burden on UK consumers. These measures should contribute to oil and gas demand falling by 85 per cent and 70 per cent by.

The three key actions by the Fed to expand the economy include a decreased.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Post a Comment for "Evaluate The Use Of Monetary Measures Applied To Ease The Burden On Consumers"