How To Get Sars Letter Online

Dont click on any links please send it to phishingsarsgovza. Pay-As-You-Earn EMP201 return Skills Development Levy included on the EMP201 and EMP501 return Unemployment Insurance Fund included on the EMP201 and EMP501 returnNote.

How To Access My Compliance Profile

How To Access My Compliance Profile

This is a secure and convenient electronic way to authorize any third party an organization or government department to view your tax compliance status online via the eFiling platform by providing them with just a PIN.

How to get sars letter online. Click on NOTICE OF REGISTRATION on the left menu. Yes you can. You may however make a copy of this letter for your records.

Click on SARS REGISTERED DETAILS on the left menu. On the Landing page tap on My Services. You do not get a printed confirmation.

When submitting the relevant material enclose this original letter as it contains a unique bar-coded reference which links it to your income tax account with SARS. However there are various way to get a SARS-issued Tax Clearance Certificate. General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C.

It also contains the organizations contact. A photocopy of this letter will not be accepted by SARS. Table of Contents 1 How to Apply Online for SAR11 Step 112 Step 213 Step 314 Step 415 Step 516 Step 6.

Click on HOME Individual profile or ORGANISATION Organisation profile on the top menu. Or see SARS COVID-19 news items and tax relief measures here. A SMS will also be sent confirming the registration was processed successfully.

Please have your ID number for it will be needed by the official during the call. This information involves the South African Revenue Service SARS online registration Portal. EFiling if you are a registered eFiler or.

The Chief or Councillor doesnt need to provide proof of residence or ID if the letter or CRA01 is for a. The taxpayer must get a letter from the Councillor in the area they live in. Visit the SARS website wwwsarsgovza Contact your registered tax practitioner.

Go to the Chrome Web Store and add the signNow extension to your browser. Remember to have your ID number or income tax number at hand when you call to enable us to assist you promptly. Should you need a copy of the Notice of Registration you can visit a SARS branch.

The same applies to SARS eFiling which is the official online tax returns submission portal for the South African Revenue Service. The first method is using eFiling and navigating SARSs e-portal by. Once your registration is successfully it will allow you to complete Transfer Duty declaration.

No PDF letters or emails or SMSs will be sent. This will display the My Services page. What happens if I forget my tax number.

Sincerely ISSUED ON BEHALF OF THE COMMISSIONER FOR THE SOUTH AFRICAN REVENUE SERVICE. If you do not get the mail track your registration process by contact SARS via 0800 00 7277. Below are five simple steps to get your sars power of attorney general form e-signed without leaving your Gmail account.

Tap on the eNotice of Registration IT150 option. Log in to your account. In this case they even include the official SARS eFiling landing page address.

Your registered email address if you have provided one. Before you can use e-Services you will have to. Login to your SARS eFiling profile.

You are required to have a valid South African ID. Note that none of these companies organizations etc have anything to do with this malspam. Visit the national COVID-19 Online Resource and News Portal at wwwsacoronaviruscoza.

Currently the following services are available. Select the Activation option on the dropdown tick the Tax compliance status and Disclaimer box then click Activate. The SARS letter is a form of an IT150Notification of registration.

How to Apply Online for SAR The City of Cape Town e-Services gives you quick access to a range of online services specifically. Simply register on eFiling and if you do not yet have a personal income tax number SARS will automatically register you and issue a tax reference number. Contact the SARS National Contact Centre If calling locally on 0800 00 7277.

UIF filing is done separately via wwwufilinggovza Value Added Tax VAT201 Provisional Tax IRP6. You need to go to your SARS eFiling profile and view this letter or call SARS on 0800 00 7277 to ask them about its contents. Select the Tax Status option at the top right-hand side of the screen.

Beware of scams pretending to be from SARS. Should you have any queries please call the SARS Contact Centre on 0800 00 SARS 7277. Select the tax compliance status on your left.

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

Https Www Sars Gov Za Alldocs Opsdocs Guides Gen Elec 18 G01 20 20how 20to 20register 20for 20efiling 20and 20manage 20your 20user 20profile 20 20external 20guide Pdf

How To Request Or View Your Notice Of Registration On Sars Efiling Youtube

How To Request Or View Your Notice Of Registration On Sars Efiling Youtube

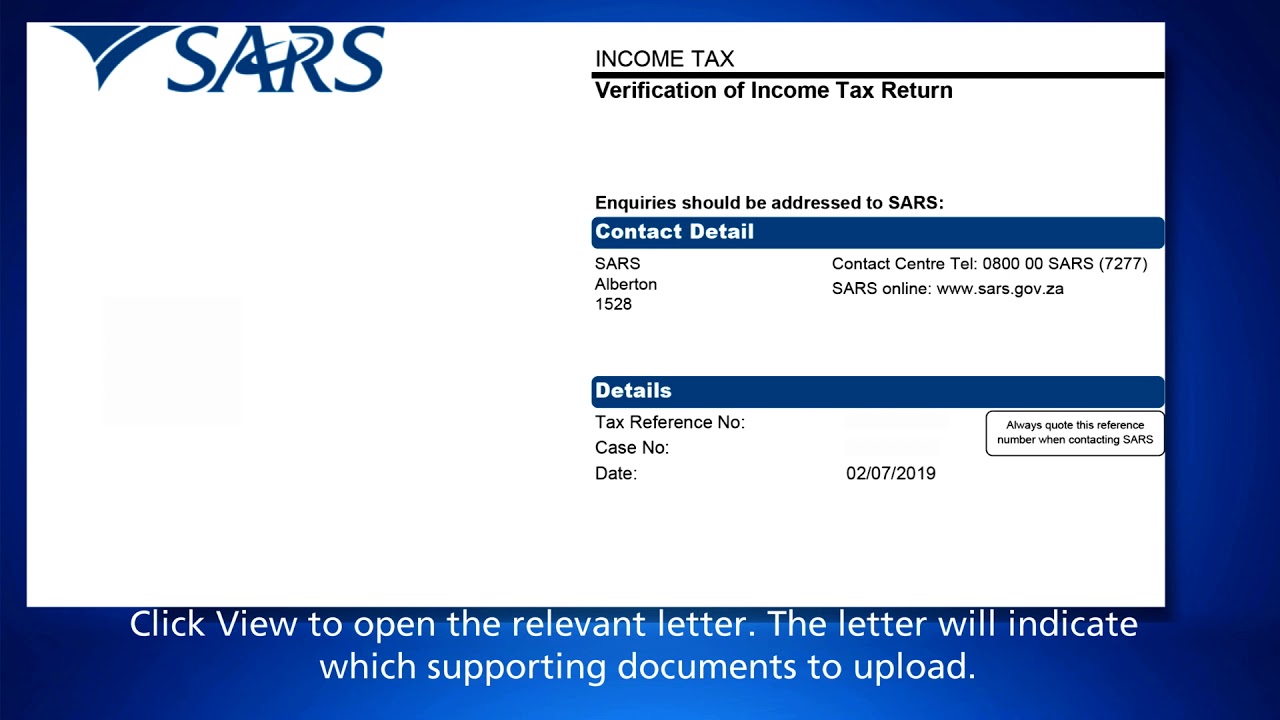

Faq How Do I Upload Supporting Documents Relevant Material On Efiling

Faq How Do I Upload Supporting Documents Relevant Material On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Post a Comment for "How To Get Sars Letter Online"