Standard Bank Money Market

R 20 000 000 and above. We give you the expert market data headlines tools and calculators you need to protect and grow your interests.

There has never been a better time to start saving than now.

Standard bank money market. Standard Bank are currently advertising their Money market Select account which offers 735 on balances over R250k. 4 Interest 41 Interest is calculated daily and capitalized monthly into the Account. Assuming youre talking about our money market and remembering that the rates adjust in real time and assuming it is R1million and one.

The manager of the Scheme is STANLIB Namibia Unit Trust Management Company Limited the Manager. In order to bring you the best possible user experience this site uses Javascript. MoneyMarket call account terms and conditions Terms 1 Introduction 11 These Terms become effective when you open a.

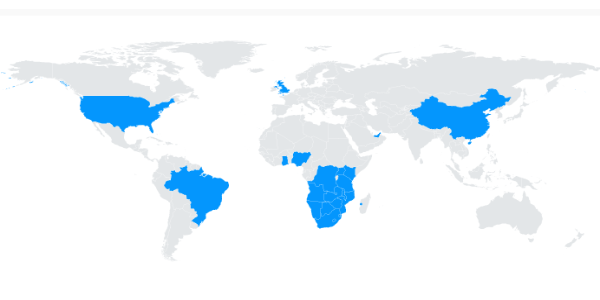

Internet banking to make international payments and transfers and manage your account. More about our Global Markets Insights Newsletter. Standard Bank Corporate Money Market Fund is an open-end investment fund incorporated in South Africa.

Whether you are growing or preserving your capital or drawing an income from your investment STANLIB has a fund for you. 00154817 2011-11 The Standard Bank of South Africa Limited Reg. Earn interest up to.

All rates are purely indicative rates and should not be used for any transactional purposes. You also have the added convenience of linking your account to a Standard Bank transactional account for simple inter-account transfers. Unlimited deposits and withdrawals.

Standard Bank transactional account if you have a transactional account with us. Our Funds - STANLIB. R 1 000 000 to R 19 999 999.

Link your bank card for access in-app online at ATMs or your phone. Our funds solutions. Interest rate based on your account balance.

The Manager is an approved Management Company in terms of the Unit Trusts Control Act No. The Standard Bank Namibia Money Market Fund is a unit portfolio portfolio of the STANLIB Namibia Unit Trust Scheme the Scheme. This week on 702 Standard Bank wants to give you R100 000 in a Standard Bank Money Market Select investment account to give your.

Designed to suit your evolving individual financial and investment needs and help you achieve your life goals Standard Banks Money Market Select Investment account. Yes depending on type of money market account - if you have Money Market Select Investment account you have to maintain min ZAR 250000 - if you have Money Market Call account min balance is ZAR 20000 - if you want to withdraw all you would need to go to your branch to withdraw and cancel your MM account. Subscribe to our newsletter.

Invest in the tomorrow you deserve with competitive returns and guaranteed growth and have anytime access to your savings. You will receive higher interest rates the higher your balance is. Informed decision-making demands 24-hour access to up-to-the-minute reliable and accurate indicators.

Interest rates are quoted as per annum rates and interest is paid out monthly. Mobile banking to manage view activity and link and transfer funds between your accounts. The Standard Bank Money Market Call Investment Account allows for easy access to your funds if you have a Standard Bank current account.

Money Market Instruments A flexible savings fund with high yields Our money market account is a cash flow management solution offering you easy access to your funds and making cash readily accessible should you need it. That sucks There are fees on deposits cash and cheque as well as a monthly management fee but I. Current effective annaul rate is 1046.

STANLIBs fund range focuses on the needs of our investors providing sufficient choice without complexity. A Standard Bank MoneyMarket Call Account gives you immediate access to your business funds. Note that the rate obtained on a Money Market Account is a daily call rate provided by Standard Bank which may change without any notification Money Market Account holders will receive comprehensive details of all movements of funds interest earned rates obtained and fees deducted on their monthly SBG Sec statement.

The Funds objective is obtain a high level of current income as is consistent with capital. The interest rates are variable tiered by balance paid monthly and calculated daily. MoneyMarket Select investment account.

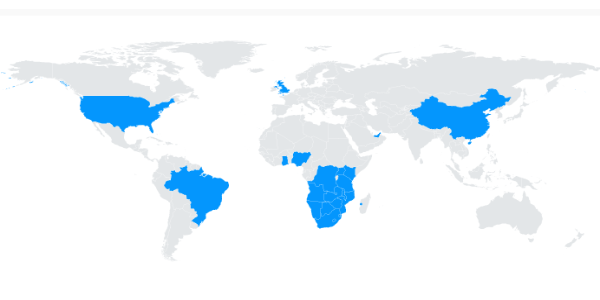

If you do not have a transactional account with us visit your nearest branch for assistance to access the funds. Money market Standard Bank - Congo. Its a safe secure and reliable way to manage your investment.

Money market activities include placement in CDF and USD. 196200073806 An authorised fi nancial services and registered credit provider NCRCP15. Standing Orders in all supported currencies and Direct Debits on sterling accounts.

If you are seeing this message it is likely that the Javascript option in your browser is disabled. If you have less than R250k you get 0. Should you choose not to capitalize your interest we will.

Standard Bank is a licensed financial services provider in terms of the Financial Advisory and Intermediary Services Act and a registered credit provider in terms of the National Credit Act registration number NCRCP15.

Standard Bank Moneymarket Call Savings Account Investing Savings And Investment Investment Accounts

Standard Bank Moneymarket Call Savings Account Investing Savings And Investment Investment Accounts

Personal Std Bank Standard Bank Mocambique

Personal Std Bank Standard Bank Mocambique

Standard Bank Pa Review Review Fees Offerings Smartasset Com

Standard Bank Pa Review Review Fees Offerings Smartasset Com

Standard Bank Also Trading As Stanbic Bank Tecng Fun Online Games Business Basics Play Game Online

Standard Bank Also Trading As Stanbic Bank Tecng Fun Online Games Business Basics Play Game Online

Trade Finance For Corporates Standard Bank Trade Finance Investment Banking Instant Money

Trade Finance For Corporates Standard Bank Trade Finance Investment Banking Instant Money

Standard Bank Professional Banking Account Review 2020 Online Share Trading Banking Investing For Retirement

Standard Bank Professional Banking Account Review 2020 Online Share Trading Banking Investing For Retirement

Personal Business Corporate And Commercial Banking In Africa Standard Bank

Personal Business Corporate And Commercial Banking In Africa Standard Bank

The Standard Bank Puresave Savings Account Is An Easy Way To Start Saving It Is Ideal For Casual Investment Accounts Online Share Trading Household Insurance

The Standard Bank Puresave Savings Account Is An Easy Way To Start Saving It Is Ideal For Casual Investment Accounts Online Share Trading Household Insurance

Post a Comment for "Standard Bank Money Market"