Nett Salary Meaning

The sum that remains following all permissible deductions including charges expenses discounts commissions or taxes. The net profit from the sale was 200.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net salary is the amount of take-home pay remaining after all withholdings and deductions have been removed from a persons salary.

Nett salary meaning. A persons salary after taxes insurance etc. Self-employed people have to pay estimated taxes on gross income which results in their net income. Net wages means take-home paythe amount on the paycheck after the employees gross earnings have been totaled and all taxes and other deductions have been subtracted from that figure.

For example Jamal is hired by a company that agrees to pay him 4000 dollars per month. Net Salary is the amount of the employees salary after deducting tax provident fund and other such deductions from the gross salary which is generally known as Take home salary. What is left of your pay after deductions for taxes and dues and insurance etc.

Definitions - net salaryreport a problem. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individuals gross pay. Thus it is the amount that employees get as their paychecks.

Net income is the amount of a persons paycheck that remains after the employer withholds taxes and deductions. Net pay also commonly known as take-home pay refers to the amount of salary that employees get after all the necessary deductions. Of a profit etc remaining after all expenses etc have been paid.

This is the amount paid to each employee on payday. Net pay is the amount of money that will finally be available to you. The residual amount is then paid to the employee in cash.

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. Remaining after all deductions as for taxes expenses losses etc Meaning pronunciation translations and examples. What is Net Pay.

Net monthly income refers to a persons take-home pay on a monthly basis. For example if your employer agreed to pay you 1500 per hour and you work for 30 hours during a pay period your gross pay will be 45000. 2 To determine net pay gross pay is computed based on how an employee is classified by the organization.

Net salary more commonly known as Take-Home Salary is the income that the employee actually takes home once tax and other such deductions are carried over with. Using our last example if you earned 45000 in gross pay your net pay will be the. Thus the net pay.

It refers to the in-hand figure that is calculated after deducting Income Tax at source TDS and. The deductions that can be taken from gross pay to. Net salary is the amount of money an individual takes home after all deductions have been made whereas the gross salary can be defined as the figure that is obtained by totalling all benefits and allowances without deducting tax.

Net assets for example are what remain after an individual subtracts the amount owed to creditors from his or her assets. Although net salary is lower than the gross salary. It is a reflection of the amount your employer pays you based on your agreed upon salary or hourly wage.

Net pay definition December 26 2020 Steven Bragg. Net salary n 1. Remaining after all deductions.

Perhaps the term used was take-home pay Individuals commonly mistake net pay and take-home pay with gross pay and there are vast differences. What is Net Salary.

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Difference Between Take Home Salary Net Salary Gross Salary Ctc

Difference Between Take Home Salary Net Salary Gross Salary Ctc

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Difference Between Gross And Net Economics Help

Difference Between Gross And Net Economics Help

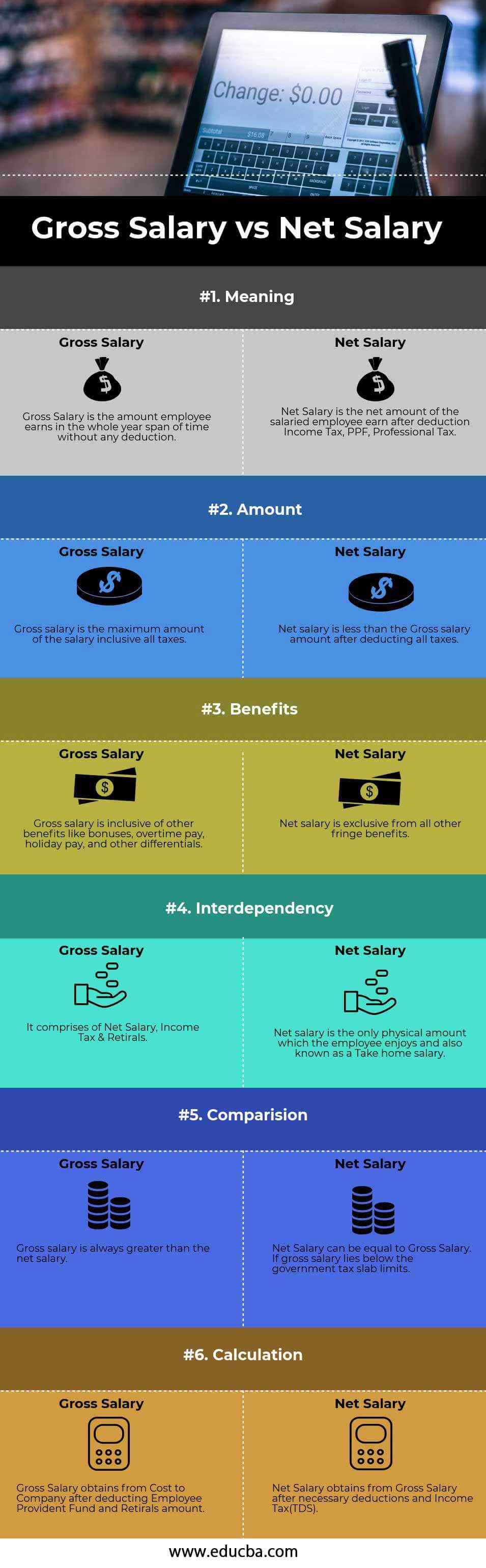

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Or Net Vocabulary Englishclub

Gross Or Net Vocabulary Englishclub

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Post a Comment for "Nett Salary Meaning"