Why Are Tobacco And Alcohol Products Returned To As Sin Tax

The Presidents proposal to raise the federal excise tax on tobacco products and use the additional revenue to expand preschool education which he included in both his fiscal year 2014 and 2015 budgets could achieve the dual goals of reducing the number of premature deaths due to smoking and raising an estimated 78 billion over ten years to finance early childhood education. Says the South African Revenue Service.

What Are Sin Taxes Sins What Are Sins Tax

What Are Sin Taxes Sins What Are Sins Tax

The average smoker spends 1660 a year on cigarettes 20 of the bottom 10s income.

Why are tobacco and alcohol products returned to as sin tax. Excise taxes are collected from the producer or wholesaler. Excise duties and levies are imposed mostly on high-volume daily consumable products for example petroleum and. The main purposes of imposing sin taxes are to reduce the consumption of harmful goods and to increase government revenue.

Most states began levying their own excise taxes on alcohol and tobacco products in the 1930s when the Great Depression dented their other revenues. With the aim of reducing sinful behaviour and financing the health care system public authorities are planning to raise the tax load on these products even higher. A sin tax is an excise tax on socially harmful goods.

The most commonly taxed goods are alcohol cigarettes gambling and pornography. With regard to alcohol and tobacco this relatively recent type of taxation takes over from a long history of high and specific taxes on these common consumer goods. A sin tax is a tax levied on goods or services that are considered to be harmful or costly to society.

The excise burdens for most types of alcoholic beverages and tobacco products currently exceed the targeted level as a result of above-inflation increases and price fluctuations reads the Budget Review. Excise duties on those products. Taxes on alcohol and tobacco reads the report are determined within a policy framework that targets the excise duty burden.

A secondary benefit of such legislation is making funds available for programs that benefit the underserved. They drive up the retail price for consumers. South Africas alcohol and tobacco industries already reeling from coronavirus restrictions that banned the sale of products are now being hit with higher taxes.

The theory behind the sin tax is the increase it causes in. Economists think it is not as easy as that. The tax placed on alcohol is known as a sin tax Sin taxes include taxes placed on alcohol and tobacco.

Package 2 of the Comprehensive Tax Reform Program proposes increasing taxes on tobacco alcohol and e-cigarette products to fund universal health care UHC and to reduce the incidence of risks associated with the consumption of sin products. Sin taxes are the most regressive indirect taxes as they tend to target products that are disproportionately consumed by the poor. The goods and services commonly include tobacco alcohol sugar-added drinks and gambling.

As global evidence suggests taxation is the single most cost-effective measure to safeguard the public from the harms of tobacco and alcohol use and their accompanying societal costs Secretary Francisco Duque III said. NZs position is to keep a watching brief at this stage on whether illicit trade is becoming a concern. President Rodrigo Duterte signed Republic Act 11467 on Wednesday which hikes the excise taxes on alcohol and imposes new duties on heated tobacco and vapor products effective January 1.

An excise tax is a flat tax imposed on each item sold. Governments hope that just as taxes on alcohol and tobacco both generate revenue and reduce smoking and drinking so sugar taxes will help curb obesity. Taxes on cigarettes and alcohol are regressive and hit the poor hardest.

It does not automatically apply to NZ as a consequence of us being a party to the FCTC. Section 3113 Page 61 NZ is not a party to the Protocol to Eliminate Illicit Trade in Tobacco Products. The Sin Tax Law helps finance the Universal Health Care program of the government simplified the current excise tax system on alcohol and tobacco products and fixed long standing structural weaknesses and addresses public health issues relating to alcohol and tobacco consumption wwwdofgovphindexphpadvocaciessin-tax-reform.

Some have gone further and argued that explicitly earmarking excise taxes on alcohol and tobacco to finance public health expendituresmarrying sin and virtue as it werewill make increasing such taxes more politically acceptable and provide the funding needed to increase such expenditures. Lawmakers sought new revenue sources that would not overly burden the already struggling population. Products with adverse health and social impacts.

Sin Tax Definition Advantages And Disadvantages

Sin Tax Definition Advantages And Disadvantages

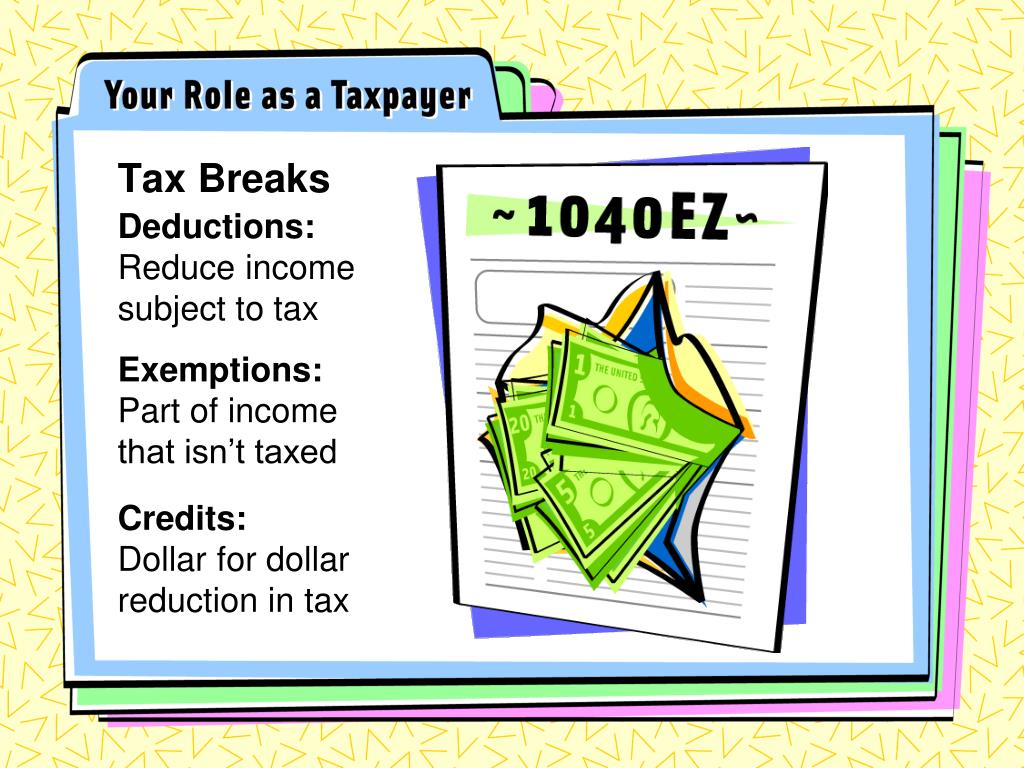

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Drink Less Alcohol Financial Tips Financial Advisors Money Management

Drink Less Alcohol Financial Tips Financial Advisors Money Management

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Got The Tax Day Blues Enjoy This Fun Infographic About Everyone S Favorite Holiday Income Tax Humor Tax Season Humor Taxes Humor

Got The Tax Day Blues Enjoy This Fun Infographic About Everyone S Favorite Holiday Income Tax Humor Tax Season Humor Taxes Humor

Sin Tax Definition Advantages And Disadvantages

Sin Tax Definition Advantages And Disadvantages

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Ppt Taxes Are What We Pay For Civilized Society Oliver Wendell Holmes Jr 1904 Powerpoint Presentation Id 5901578

Post a Comment for "Why Are Tobacco And Alcohol Products Returned To As Sin Tax"